Share Information

Total Outstanding Shares

23. Equity Capital stock consists of (amounts in thousands, except for par value and number of shares):

|

Number of shares |

Amount (in thousands) |

| 2024 |

2023 |

2024 |

2023 |

Common - ₱10 par value

Authorized

|

₱1,470,000,000 |

₱1,470,000,00 |

₱14,700,000 |

₱14,700,000 |

Issued and Outstanding

Balance at the beginning of the year

|

₱727,965,795

|

₱727,965,795

|

₱7,279,658

|

₱7,279,658

|

With the approval of the SEC on May 6, 2013, a total of 88,000,000 offer shares consisting of 80,000,000 firm shares and 8,000,000 optional shares pursuant to the over-allotment option were issued and offered by the Parent Company, with ₱10.00 par value per share through an initial public offering at ₱95.00 per share from May 7 to 14, 2013. The Parent Company’s shares were listed and commenced trading at the PSE on May 17, 2013.

The net proceeds from the IPO amounted to ₱7.46 billion, net of direct costs related to equity issuance of ₱0.48 billion.

On December 5, 2023, the SEC, upon consideration of the application for the increase of capital stock of the Parent Company from ₱5.00 billion to ₱14.70 billion, resolve to authorize the issuance of no less than 242.5 million shares of the par value of ₱10.00 or ₱2,425 million to cover the 50% stock dividends declared on May 26, 2023 by BOD of the Parent Company and ratified by the corporation's stockholders representing at least 2/3 of the outstanding capital stock on June 23, 2023 and the issuance of shares of stocks to stockholders of record as of December 18, 2023.

As of December 31, 2024 and 2023, respectively, there are 120 and 118 entities and individuals that are holders of the Bank's securities.

Surplus

On June 28, 2024, the BOD of the Parent Company approved the declarations of cash dividends amounting to ₱968.19 million (or ₱1.33 per share) and ₱727.97 million (or ₱1.00 per share) to stockholders of record as of July 12, 2024 and September 6, 2024, payable on July 31, 2024 and September 30, 2024, respectively.

On November 24, 2023, the BOD of the Parent Company approved the declarations of cash dividends amounting to ₱242.66 million (or ₱0.33 per share) to stockholders of record as of December 19, 2023 payable on December 22, 2023.

On May 26, 2023, the BOD of the Parent Company approved the declarations of cash dividends amounting to ₱485.31 million (or ₱1.00 per share) and ₱485.31 million (or ₱1.00 per share) to stockholders of record as of June 9, 2023 and September 12, 2023, payable on July 6, 2023 and September 28, 2023, respectively.

On May 26, 2023, the BOD of the Parent Company approved the 50% stock dividend amounting to 242,655,257 shares to stockholders of record as of December 18, 2023 distributable on December 22, 2023.

On May 26, 2023, the BOD of the Parent Company approved the declarations of cash dividends amounting to ₱485.31 million (or ₱1.00 per share) and ₱485.31 million (or ₱1.00 per share) to stockholders of record as of June 9, 2023 and September 12, 2023, payable on July 6, 2023 and September 28, 2023, respectively.

On June 24, 2022, the BOD of the Parent Company approved the declarations of cash dividends amounting to ₱485.31 million (or ₱1.00 per share) and ₱485.31 million (or ₱1.00 per share) to stockholders of record as of July 15, 2022 and October 14, 2022, payable on July 29, 2022 and October 31, 2022, respectively.

Included in this account is the difference between the 1% general loan loss provision (GLLP) over the computed ECL allowance for credit losses related to Stage 1 accounts, as a required BSP appropriation. As of December 31, 2024 and 2023, surplus reserves related to the difference between GLLP over ECL allowance amounted to ₱1.40 billion and ₱0.79 billion for the Parent Company.

Capital Management

The primary objective of the Group’s capital management is to ensure that the Parent Company complies with externally imposed capital requirements and that the Group maintains strong credit ratings and healthy capital ratios in order to support its business and to maximize shareholders’ value.

The Group manages its capital structure and makes adjustments to it in the light of changes in economic conditions and the risk characteristics of its activities and assessments of prospective business requirements or directions. In order to maintain or adjust the capital structure, the Group may adjust the amount of dividend payment to shareholders, return capital to shareholders or issue capital securities. No changes were made in the objectives, policies and processes from the previous years.

Regulatory Qualifying Capital

Under existing BSP regulations, the determination of the Parent Company’s compliance with regulatory requirements and ratios is based on the amount of the Parent Company’s unimpaired capital (regulatory net worth) reported to the BSP, determined on the basis of regulatory accounting policies, which differ from PFRS Accounting Standards in some respects.

Effective January 1, 2014, the Group complied with BSP issued Circular No. 781, Basel III Implementing Guidelines on Minimum Capital Requirements, which provides the implementing guidelines on the revised risk-based capital adequacy framework particularly on the minimum capital and disclosure requirements for universal banks and commercial banks, as well as their subsidiary banks and quasi-banks, in accordance with the Basel III standards. The Circular sets out a minimum Common Equity Tier 1 (CET1) ratio of 6.00% and Tier 1 capital ratio of 7.50% and also introduced a capital conservation buffer of 2.50% comprised of CET1 capital. The existing requirement for Total Capital Adequacy Ratio (CAR) remains unchanged at 10.00% and these ratios shall be maintained at all times.

Basel III also requires that existing capital instruments as of December 31, 2010 which do not meet the eligibility criteria for capital instruments under the revised capital framework shall no longer be recognized as capital. In addition, capital instruments issued under BSP Circular Nos. 709 and 716 (the circulars amending the definition of qualifying capital particularly on Hybrid Tier 1 and Lower Tier 2 capitals) and before the effectivity of BSP Circular No. 781, are recognized as qualifying capital until December 31, 2015. In addition to changes in minimum capital requirements, this Circular also requires various regulatory adjustments in the calculation of qualifying capital.

On June 27, 2014, the BSP issued Circular No. 839, REST Limit for Real Estate Exposures which provides the implementing guidelines on the prudential REST limit for universal, commercial, and thrift banks on their aggregate real estate exposures. The Group should maintain CET1 and CAR levels at the regulatory prescribed minimums, on a solo and consolidated basis, even after the simulated results of a 25.00% write-off to the Group’s real estate exposures. These shall be complied with at all times.

Capital Adequacy Ratio (CAR)

The capital-to-risk assets ratio reported to the BSP as of December 31, 2024 and 2023 based on Basel III are shown in the table below (amounts in millions):

|

Consolidated |

Parent Company |

|

2024 |

2023 |

2024 |

2023 |

|

Tier 1 capital

|

₱51,926

|

₱43,222

|

₱50,250

|

₱42,140

|

|

CET1 Capital*

|

51,926

|

43,222

|

50,250

|

42,140

|

|

Tier 2 capital

|

2,293

|

1,565

|

2,265

|

1,537

|

|

Total qualifying capital

|

₱54,219

|

₱44,787

|

₱52,515

|

₱43,677

|

Risk Weighted Assets

|

₱304,946

|

₱256,036

|

₱298,668

|

₱249,625

|

|

*net of regulatory adjustments to CET1 Capital

|

Capital ratios

|

Total regulatory capital expressed as

percentage of total risk weighted assets

|

17.78%

|

17.49%

|

17.67%

|

17.50%

|

Total CET1 expressed as

percentage of total risk weighted assets

|

17.03%

|

16.88%

|

16.92%

|

16.88%

|

Total tier 1 expressed as

percentage of total risk weighted assets

|

17.03%

|

16.88%

|

16.92%

|

16.88%

|

Qualifying capital and risk-weighted assets (RWA) are computed based on BSP regulations.

Under Basel III, the regulatory qualifying capital of the Parent Company consists of CET1 capital, which comprises paid-up common stock, surplus including current year profit, surplus reserves, other comprehensive income (net unrealized gains or losses on FVOCI securities and cumulative foreign currency translation) and non-controlling interest less required deductions such as unsecured credit accommodations to directors, officers, stockholders and related interests (DOSRI), deferred income tax, other intangible assets, defined benefit pension fund assets and goodwill. The other component of qualifying capital is Tier 2 (supplementary) capital, which includes subordinated debt and general loan loss provision.

Risk-weighted assets are determined by assigning defined risk weights to the balance sheet exposure and to the credit equivalent amounts of off-balance sheet exposures. Certain items are deducted from risk-weighted assets, such as the excess of general loan loss provision over the amount permitted to be included in Tier 2 capital. The risk weights vary from 0.00% to 150.00% depending on the type of exposure, with the risk weights of off-balance sheet exposures being subjected further to credit conversion factors.

The risk-weighted CAR is calculated by dividing the sum of its Tier 1 and Tier 2 capital by its risk-weighted assets, as defined under BSP regulations. The determination of compliance with regulatory requirements and ratios is based on the amount of the Group’s and Parent Company’s ‘unimpaired capital’ (regulatory net worth) as reported to the BSP, which is determined on the basis of regulatory accounting practices which differ from PFRS Accounting Standards in some respects.

As at December 31, 2024 and 2023, the Group and the Parent Company were in compliance with the minimum CAR, as reported to the BSP.

With the issuance of BSP Circular No. 639 covering the Internal Capital Adequacy Assessment Process (ICAAP) in 2009, which supplements the BSP’s risk-based capital adequacy framework under Circular No. 538, the Group has adopted and developed its ICAAP framework to ensure that appropriate level and quality of capital are maintained by the Group on an ongoing basis. The level and structure of capital are assessed and determined in light of the Group’s business environment, plans, performance, risks and budget, as well as regulatory edicts.

Basel III Leverage Ratio (BLR)

BSP Circular Nos. 881 and 990 cover the implementing guidelines on the BLR framework designed to act as a supplementary measure to the risk-based capital requirements and shall not be less than 5.00%. The monitoring period has been set every quarter starting December 31, 2014 and extended until June 30, 2018. Effective July 1, 2018, the monitoring of the leverage ratio was implemented as a Pillar I minimum requirement.

As of December 31, 2024, and 2023, the details of BLR reported to the BSP are shown in the table below; (amounts in millions, except for percentages):

|

Consolidated |

Parent Company |

|

2024 |

2023 |

2024 |

2023 |

|

Tier 1 capital

|

₱51,926

|

₱43,222

|

₱50,250

|

₱42,140

|

|

Exposure measure

|

394,055

|

359,903

|

387,066

|

353,518

|

|

Leverage ratio

|

13.18%

|

12.01%

|

13.05%

|

11.92%

|

Under the framework, BLR is defined as the capital measure divided by the exposure measure.

Capital measure is Tier 1 capital. Exposure measure is the sum of on-balance sheet exposures, derivative exposures, security financing exposures and off-balance sheet items.

Liquidity Coverage Ratio (LCR)

BSP Circular No. 905 provides the implementing guidelines on LCR and disclosure standards that are consistent with the Basel III framework. The LCR is the ratio of high-quality liquid assets to total net cash outflows which should not be lower than 100.00%. Compliance with the LCR minimum requirement commenced on January 1, 2018 with the prescribed minimum ratio of 90.00% for 2018 and 100.00% effective January 1, 2019. As of December 31, 2024 and 2023, the LCR in single currency as reported to the BSP, was at 129.80% and 182.77%, respectively, for the Group, and 130.22% and 185.13%, respectively, for the Parent Company.

Net Stable Funding Ratio (NSFR)

On June 6, 2018, the BSP issued BSP Circular No. 1007 covering the implementing guidelines on the adoption of the Basel III Framework on Liquidity Standards NSFR. The NSFR is aimed to promote long-term resilience against liquidity risk by requiring banks to maintain a stable funding profile in relation to the composition of its assets and off-balance sheet activities. It complements the LCR< which promotes short-term resilience of a bank's liquidity profile. Banks shall maintain an NSFR of at least 100 percent (100%) at all times. The implementation of the minimum NSFR shall be phased in to help ensure that covered banks can meet the standard through reasonable measures without disrupting credit extension and financial market activities. An observation period was set from July 1 to December 31, 2018. Effective, January 1, 2019, banks shall comply with the prescribed minimum ratio of 100%. As of December 31, 2024 and 2023, the NSFR as reported to the BSP, was at 143.27% and 141.31%, respectively, for the Group, and 144.30% and 142.38%, respectively for the Parent Company.

Stock Listing

Asia United Bank (AUB) common shares are listed and traded at the Philippine Stock Exchange (PSE) under the ticker symbol “AUB”. The Parent Company’s shares were listed and first traded on May 17, 2013.

Top 20 Stockholders

Please click here

Foreign and Public Ownership

Monthly Foreign Ownership Report

Quarterly Public Ownership Report

Share Price Information

Please click here

Shareholder Assistance and Services

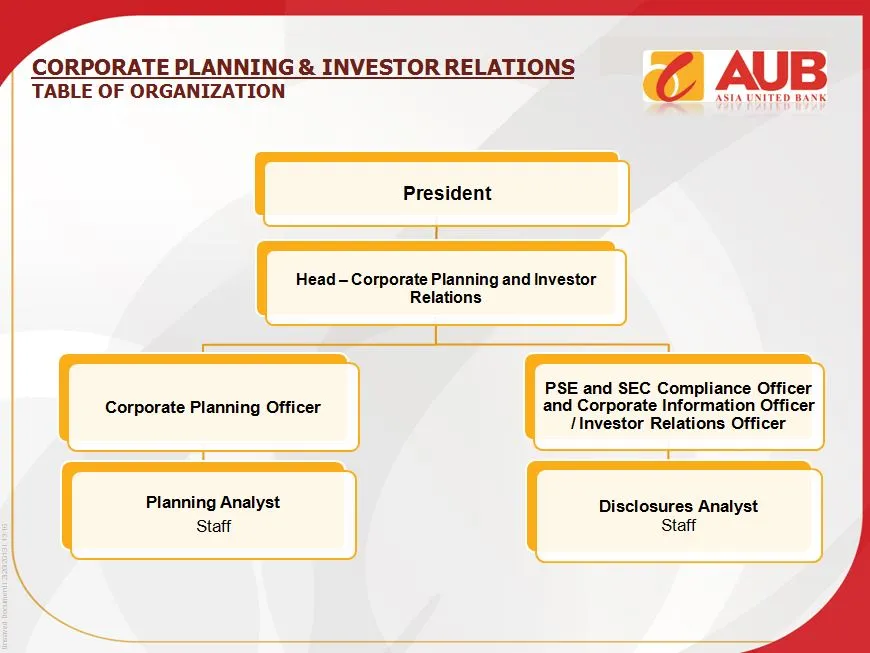

For investor relations, please write, email or call:

Kristel G. Azucena - The Investor Relations Officer

33/F Joy-Nostalg Center, 17 ADB Avenue, Ortigas Center, Pasig City, Philippines

Email: investorrelationsoffice@aub.com.ph

Tel. Nos. (632) 8638-8888 or 8631-3333 local 169.

For shareholder services, please write, email,or call:

Richard D. Regala - General Manager

Stock Transfer Service, Inc., 34-D Rufino Pacific Tower, 6784 Ayala Avenue, Makati City

Email: rdregala@stocktransfer.com.ph

Tel. No. 5310-1343

Maricor Biag - Analyst

Stock Transfer Service, Inc., 34-D Rufino Pacific Tower, 6784 Ayala Avenue, Makati City

Email: mpbiag@stocktransfer.com.ph

Tel. No. 5310-1343